Refinancing a mortgage setting substitution your existing home loan with a new one probably help you save money. But breaking even needs time to work once upfront costs.

Refinancing a mortgage are an effective circulate for you when the you could lower your latest interest otherwise shorten their label to store on your monthly installments. However, those people aren’t the only causes.

Perchance you must faucet your own house’s equity for cash, get out of investing personal financial insurance (PMI), otherwise go from an adjustable to a fixed-price home loan. There are numerous good reasons so you can re-finance, not to mention several reasons to not ever.

Specific gurus expect that home loan cost , which will make refinancing more inviting. But not, the best time so you’re able to re-finance is not only when interest rates drop-it’s if it aligns along with your monetary wants. The following is a review of exactly how refinancing performs whenever its correct for your requirements.

Create Kiplinger’s Free Elizabeth-Newsletters

Cash and you can prosper on best of professional advice with the purchasing, taxes, advancing years, personal finance and – right to their age-post.

How mortgage refinancing performs

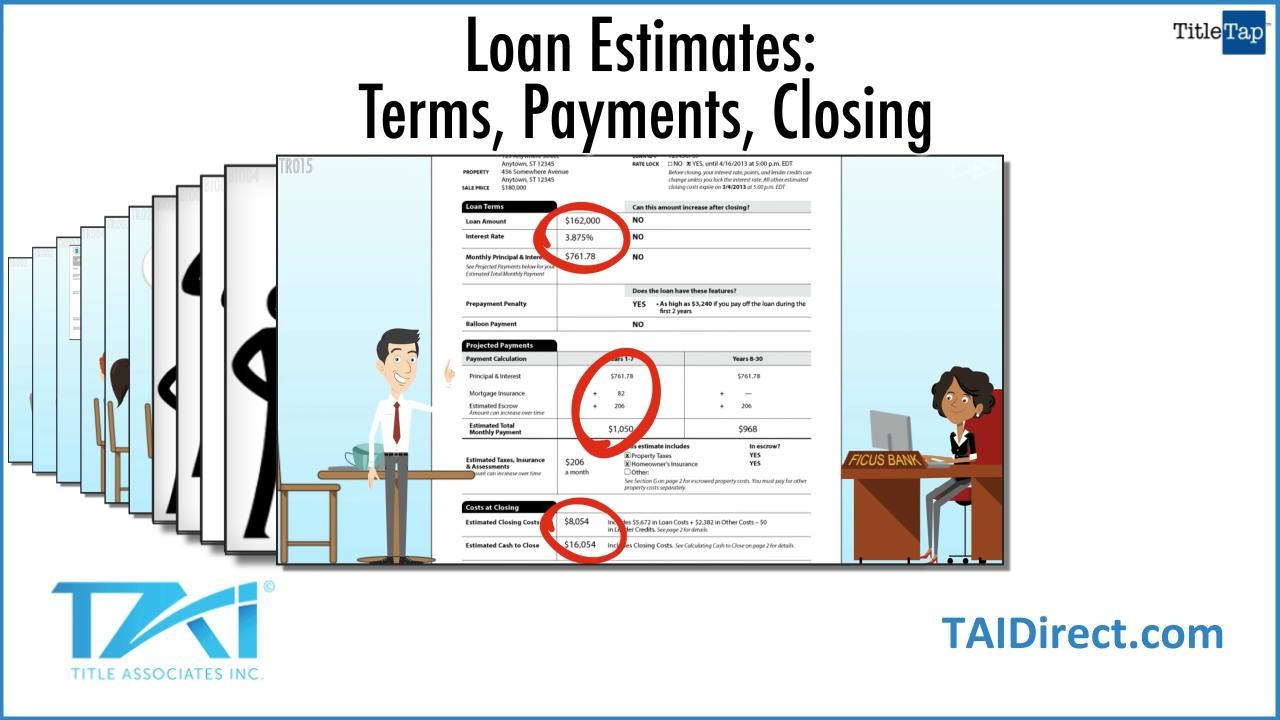

Refinancing mortgage functions by replacement your existing mortgage which have yet another you to definitely, if at all possible that have greatest terms and conditions, less interest and you may the new (develop all the way down) monthly premiums. When you refinance, you usually pay settlement costs and you may charge.

You will never receive money from the mortgage unless you are creating a beneficial cash-aside re-finance. Alternatively, their bank uses the mortgage add up to pay your established home loan. After closing, you can start making monthly installments to the the latest mortgage.

Instance, for individuals who refinance your existing 29-12 months home loan to help you a 15-12 months financial, just how many years you reduced on your brand new financing doesn’t amount because your payments will start over and you will last for the new next fifteen years.

The kind of refinance loan you decide on would depend available on the most recent condition, preferences. You are able to faucet the newest equity in your possessions and you can make use of it to finance a massive expenses, otherwise replace the interest rate and you can regards to your home loan to reduce your monthly payments.

Any kind of variety of refinancing going for, just be sure the pros outweigh the costs. Yes, you will probably spend closing costs and possibly loan providers charge towards good refinance just as you did with your earliest mortgage. Actually, refinancing your own home loan can cost ranging from step three% in order to six% of your brand new loan amount, with respect to the Government Reserve.

Particularly, if you nonetheless are obligated to pay $350,000 on the home, anticipate paying anywhere between $10,500 so you can $21,000 during the re-finance charge. However, comparison shop, since these will set you back may differ by bank.

You should do some math to decide although it is well worth refinancing. It will require a couple of years toward obtained monthly coupons so you can exceed the brand new closing costs in your refinance or perhaps the break-actually draw.

Which type of home loan refinance suits you?

Speed and you will label refinancing, which enables you to replace the interest rate and you will terms of your own present home loan, is considered the most prominent style of refinancing. The financial balance wouldn’t changes, however your monthly payment could possibly get get rid of due to a reduced notice price otherwise expanded repayment title.

These refinancing could also be used so you’re able to shorten their cost title. Your own payment get raise, however you will pay off the loan shorter and save money from inside the attract over the life of your brand-new financing.

An earnings-aside refinance lets you tap into brand new equity in your property. It substitute your existing mortgage with a brand new, large mortgage, providing you with accessibility the essential difference between both within the real money. The regards to your own refinance you are going to differ notably from the brand spanking new mortgage loan, also brand new prices and you will words.